Forklift Cost Comparison: Buy, Rent, or Lease?

Choosing the right forklift strategy is critical for businesses that rely on efficient material handling. Making a bad decision can result in throwing away money, experiencing downtime, and facing ongoing inefficiencies. Whether you manage a warehouse, supervise a construction project, or run a logistics company, forklifts are essential to productivity.

This article provides a comprehensive forklift cost comparison by analyzing buying, renting, and leasing. It is designed to help warehouse managers, construction supervisors, logistics companies, small business owners, and sellers of used forklifts find the most cost-efficient option. With insights into average forklift cost, forklift rental cost, and forklift leasing options, you will be better prepared to make an informed decision.

Understanding Forklift Costs

The decision to buy, rent, or lease begins with understanding the full scope of forklift expenses. These costs go beyond the initial price and include fuel, electricity, insurance, and resale value. Considering all factors makes a forklift cost comparison more accurate.

Key Components of Forklift Costs

When evaluating the average forklift cost, key factors include:

- Purchase price: New forklifts usually range from $20,000 to $100,000+, while reconditioned or used models are far less expensive. Heavy-duty forklifts often cost considerably more than standard versions.

- Operational costs: Fuel or electricity, charging systems, and routine servicing affect long-term budgets significantly.

- Depreciation and resale value: Purchased forklifts can be resold or traded in, which helps recover part of the original cost.

Understanding these elements allows buyers to better compare forklift leasing options with outright ownership.

Hidden and Ongoing Costs

Beyond the obvious, hidden expenses can add up quickly:

- Repairs and downtime: Equipment failures reduce efficiency and may halt operations for hours or days. Costs include both repairs and lost productivity while the machine is idle.

- Safety compliance: Meeting OSHA and local safety standards requires inspections, certifications, and occasional upgrades. Expenses include both direct fees and indirect labor costs for preparing machines for compliance.

- Insurance and transportation: Forklifts require insurance coverage to protect against accidents and liability. Delivery or relocation adds additional fees, especially for large models or multi-site operations.

These factors must be included to make a realistic forklift cost comparison between ownership, leasing, and renting.

Buying a Forklift

Buying a forklift works best for businesses with daily, long-term needs. Ownership provides control and independence that rentals or leases cannot match.

Costing of Buying a Forklift

- New forklifts: Standard electric or internal combustion models usually cost $20,000 to $55,000. Heavy-duty forklifts can range from $70,000 to well over $100,000. Electric forklifts often require batteries and chargers, adding $10,000 to $20,000 to the total.

- Used forklifts: Reconditioned forklifts are more affordable, often priced between $5,000 and $30,000 depending on age, hours, and condition. Low-hour, well-maintained units may reach $35,000 to $45,000, while older machines may be available for less than $10,000.

- Overall ownership view: Considering both new and used options helps businesses calculate realistic ownership costs. Companies can balance upfront investment against long-term performance and resale potential.

Advantages of Buying

- Asset equity: Each payment builds ownership, creating an asset that can later be resold or traded in. This equity strengthens a company's financial position and provides value during future upgrades.

- Lower long-term costs: For businesses that use forklifts daily, buying is often less expensive than renting. Spreading the purchase cost across years of service lowers the average hourly expense. It also avoids premium rental fees during peak demand.

- Customization: Ownership allows equipment to be tailored with attachments, safety features, or technology upgrades. These improvements enhance efficiency and extend the useful life of the machine.

Drawbacks of Buying

- High upfront investment: Purchasing new forklifts requires significant capital, often between $20,000 and $100,000 or more. This expense can strain budgets and limit cash flow for other needs.

- Maintenance responsibility: Owners are responsible for covering the entire cost of both scheduled maintenance and any surprise repairs that may come up. Parts, labor, and downtime add up, requiring careful planning and resources.

- Risk of outdated equipment: Technology changes quickly, and owned forklifts may fall behind in efficiency or safety standards. Leasing offers built-in upgrades, while ownership may leave companies with older models that lack new features.

For businesses with limited cash flow, the high average forklift cost may outweigh the benefits of ownership.

Renting a Forklift

Renting is ideal for short-term projects, seasonal demand, or sudden equipment needs. It offers the flexibility you need without the burden of a hefty upfront cost.

Costing of Renting a Forklift

- Daily or weekly rates: Short-term rentals usually cost $100 to $200 per day, or $250 to $700 per week, depending on model and size.

- Monthly rentals: Long-term rentals often range from $750 to $2,500 per month. Smaller electric models fall on the lower end, while heavy-duty forklifts cost more.

- Used rental fleet: Some providers rent older forklifts at reduced rates. These options save money but may lack the newest features.

Advantages of Renting

- Low upfront cost: Renting avoids the need for a major purchase. Companies access equipment immediately without tying up capital.

- Maintenance included: Rental contracts usually cover servicing, inspections, and repairs. This minimizes surprise expenses and ensures reliable performance.

- Scalability: Renting allows companies to adjust fleet size quickly. Businesses can add forklifts during busy seasons and return them when demand slows.

Drawbacks of Renting

- Higher expense for ongoing use: Continuous rentals can cost more than buying, making them less practical for daily, long-term needs.

- No ownership: Rental payments build no equity or resale value. Once the contract ends, the company owns nothing.

- Availability issues: During peak demand, the specific model needed may not be available. This can cause delays or force businesses to settle for less suitable equipment.

For companies with ongoing needs, forklift leasing or buying may provide better value.

Leasing a Forklift

Leasing combines the benefits of access to newer machines with predictable monthly payments. It works well for businesses that want updated equipment without heavy upfront costs.

Costing of Leasing a Forklift

- Monthly lease payments: Typically, leasing costs range from $300 to $1,500 per month, with the price influenced by the size and brand of the forklift. Smaller electric forklifts are at the lower end, while specialized or heavy-duty models cost more.

- Lease term length: Most leases last between 36 and 84 months. Longer leases lower monthly payments but raise the overall total, while shorter terms allow faster upgrades.

- New vs. used forklifts: Leasing new forklifts provides access to the latest technology, though at a higher monthly cost. Leasing reconditioned units reduces payments, often between $250 and $800 per month, but may involve higher maintenance.

Advantages of Leasing

- Lower monthly payments: Leasing keeps monthly expenses lower compared with renting or financing a purchase. This makes budgets easier to manage.

- Access to modern equipment: Lease agreements often allow upgrades during the contract. Companies benefit from newer models without making large purchases.

- Predictable budgeting: Fixed lease terms provide consistent monthly costs. This improves financial planning and supports long-term stability.

Drawbacks of Leasing

- Higher total cost over time: Over many years, leasing can cost more than buying outright. Payments add up and may exceed the price of ownership.

- No asset ownership: At the end of the lease, the forklift must be returned. Businesses do not build equity or gain resale value.

- Contract risks: Lease terms often require long commitments. If demand changes, companies may still be obligated to pay, limiting flexibility.

For businesses comparing forklift cost options, leasing provides predictability but no ownership.

Buy vs. Rent vs. Lease – Cost Comparison

Making the right choice requires comparing the full range of costs and benefits. A complete forklift cost comparison looks beyond the upfront price to long-term effects.

Short-Term vs. Long-Term Needs

- Short-term use: Renting is often the most practical option for temporary projects or seasonal demand. The forklift rental cost remains affordable for limited use.

- Long-term use: Buying or leasing is generally more cost-effective for continuous use. Buying builds equity, while leasing provides regular upgrades.

ROI and Operational Efficiency

- Reliability: Owned and leased forklifts often provide steady performance, reducing downtime and maintaining workflow.

- Maintenance: Rentals include service, while owned machines require ongoing attention. Proper upkeep ensures dependable operation.

- Productivity: Equipment shortages or breakdowns hurt efficiency and profits. Reliable forklifts keep projects on schedule and operations moving smoothly.

Additional Considerations

Other factors also affect whether buying, renting, or leasing is best for your business.

Nationwide Availability and Service Support

- Rental support: Rental agreements usually provide fast service response, reducing downtime.

- Lease agreements: Leases often include comprehensive service plans, covering inspections and routine maintenance.

- Ownership maintenance: Owners must arrange independent servicing and build maintenance partnerships. This requires planning but allows more control over how machines are cared for.

Reconditioned Forklifts and Trade-In Options

- Reconditioned forklifts: These come with warranties and are priced lower than new models. They balance cost and reliability for businesses with tighter budgets.

- Trade-in programs: Dealers often accept older forklifts as trade-ins, reducing the cost of a replacement. This makes upgrading equipment more affordable and practical.

Value Forklifts – Helping You Find the Right Used Forklift

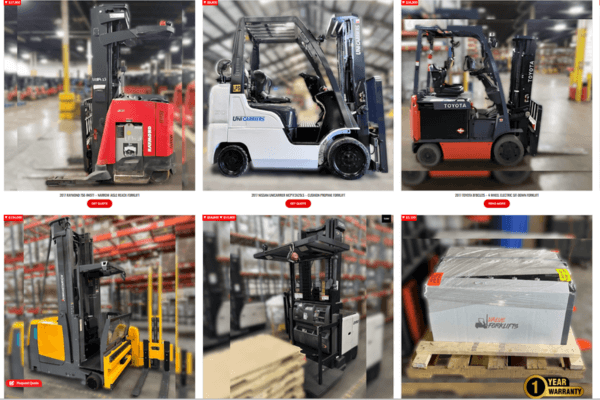

At Value Forklifts, we have helped businesses improve efficiency for more than 30 years. We provide fully serviced, reconditioned forklifts from trusted brands such as Hyster, Yale, Cat, and Toyota. Each machine is carefully inspected, tested, and ready for use.

Our inventory includes propane, electric, stand-up, narrow aisle reach trucks, and pickers. Whether you need cost-effective solutions or high-performance equipment, we match forklifts to your requirements.

With nationwide shipping, expert guidance, and trade-in programs, we make it easier to manage the average forklift cost while boosting efficiency. Whether you are buying, upgrading, or trading, Value Forklifts ensures you get strong value compared with typical forklift rental or forklift leasing options.

Conclusion

The choice between buying, renting, or leasing depends on your company's needs, budget, and long-term plans. Buying builds equity but requires heavy investment and ongoing maintenance. Renting is flexible and low-cost upfront, but it grows expensive with constant use. Leasing delivers predictable monthly payments and access to newer machines but does not provide ownership.

By carefully weighing average forklift cost, forklift rental cost, and forklift leasing options, businesses can make decisions that improve efficiency and profitability. Considering hidden expenses, return on investment, and operational impact leads to a balanced choice that supports both financial stability and productivity.

Ready to reduce equipment costs and improve operations? Contact Value Forklifts today and let our team connect you with the right used forklift for your needs.

Frequently Asked Questions (FAQs)

Is it better to buy or lease a forklift?

- It depends on use. Buying works well for daily, long-term needs, while forklift leasing suits companies that want lower monthly payments and access to newer models.

Which is more expensive, lease or rent?

- For short-term projects, renting is usually cheaper. Over time, leases often cost less than continuous forklift rental costs.

How much does it cost to lease a forklift?

- Forklift leasing options typically range from a few hundred to more than a thousand dollars per month, depending on model and contract length.

Why rent a forklift instead of buying?

- Renting avoids a large upfront cost, includes maintenance, and works well for temporary projects where ownership is not practical.

How does a forklift lease work?

- Leases involve monthly payments for a set period, often with servicing included. At the end, the forklift is returned, or a new lease is negotiated.

How long does the average forklift last?

- With proper maintenance, the average forklift provides 10,000 to 20,000 operating hours, or about 7 to 10 years of typical use.